Ameriprise Net Worth Calculator: A Simple Approach

Planning your financial future requires understanding your current net worth (the difference between your assets and liabilities). Ameriprise's net worth calculator offers a straightforward method for determining this crucial figure. Is it the perfect tool for everyone? Let's find out.

Ameriprise’s calculator prioritizes ease of use. Its clean interface makes it ideal for beginners or those seeking a quick snapshot of their financial health. You input your assets (savings, investments, property) and liabilities (loans, credit card debt), and the calculator instantly provides your net worth.

Pros:

- Intuitive Interface: The simple design makes it easy to use, even for those unfamiliar with financial planning tools.

- Quick Results: Get a near-instant calculation of your current net worth.

Cons:

- No Projection Feature: It only calculates your current net worth, offering no insight into future financial projections.

- Limited Data Input: The calculator supports a limited number of asset and liability categories.

[Insert Screenshot of Ameriprise Calculator Here]

CalcXML Net Worth Calculator: A More Comprehensive Outlook

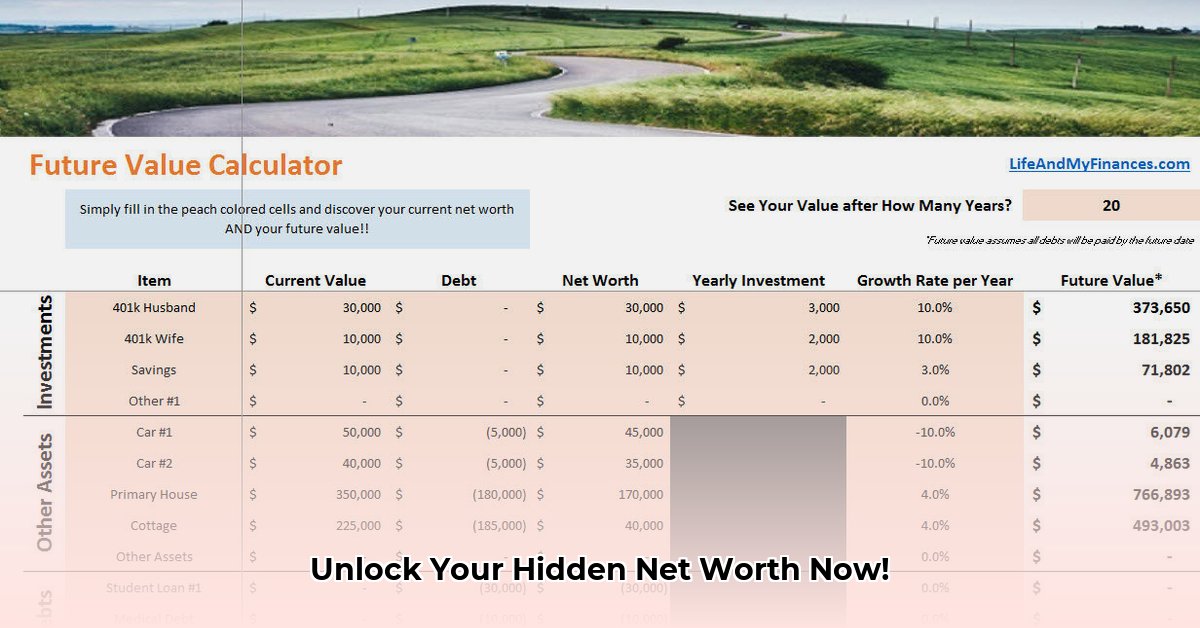

While Ameriprise focuses on simplicity, CalcXML offers a more powerful, albeit complex, tool. This calculator allows you to project your net worth into the future, providing valuable insights for long-term financial planning. However, this added functionality comes with a steeper learning curve.

Pros:

- Future Projections: A key advantage is its ability to project your net worth over time, considering potential growth and changes in assets and liabilities.

- Detailed Input Options: Provides more granular input fields, allowing for more accurate modeling of different financial scenarios.

Cons:

- Steeper Learning Curve: The interface is more complex and may require some time to master.

- Lack of Transparency in Projections: The underlying calculations for future projections may not be entirely clear.

[Insert Screenshot of CalcXML Calculator Here]

Comparative Analysis: Ameriprise vs. CalcXML

The following table summarizes the key differences between the two calculators, highlighting their strengths and weaknesses:

| Feature | Ameriprise | CalcXML |

|---|---|---|

| Interface | Simple, user-friendly | More complex, detailed |

| Projection | No | Yes |

| Data Input | Limited categories | Granular options |

| Ease of Use | High | Moderate |

| Best For | Quick net worth assessment | Long-term financial planning & projections |

A Step-by-Step Guide to Using Each Calculator

Ameriprise:

- Navigate to the Ameriprise website and locate their net worth calculator.

- Enter your assets and liabilities accurately.

- Review the calculated net worth.

CalcXML:

- Access the CalcXML net worth calculator.

- Input your current assets and liabilities.

- Estimate future growth rates for each asset and liability.

- Select a projection timeframe.

- Analyze the projected net worth over time.

Limitations and Cautions: The Bigger Picture

Both calculators have limitations. Neither accounts for inflation, taxes, or unexpected life events. These tools should be considered as starting points for financial planning, not definitive predictions. A comprehensive financial plan should incorporate additional factors and ideally should be developed with the guidance of a financial advisor. Don't rely solely on a calculator—seek professional advice for personalized financial guidance.

Conclusion: Choosing the Right Tool

Ameriprise’s calculator excels for quick net worth assessments. CalcXML is better suited for long-term planning and detailed financial projections, but requires more effort and financial understanding. Remember to use these tools responsibly and seek professional help for personalized financial strategies. What are your thoughts on using online calculators for net worth projections? Have you used either of these tools? Share your experiences!